Unemployment tax withholding calculator

Updated for your 2021-2022 taxes simply enter your tax information and adjust your withholding to understand. IRS tax forms.

Covid 19 Unemployment Tax Withholding

Estimate your paycheck withholding with our free W-4 Withholding Calculator.

. 2 This amount would be reported on the appropriate reporting form. To calculate your weekly benefits amount you should. This Estimator is integrated with a W-4 Form.

Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34. FUTA taxes named for the Federal Unemployment Tax Act are payments of a percentage of employees wages that. Take a look at the base period where you received the highest.

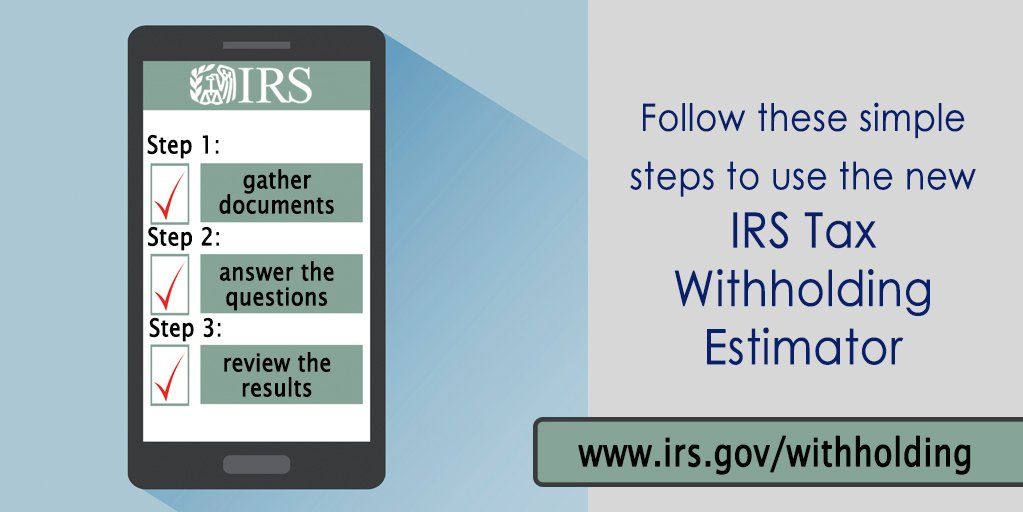

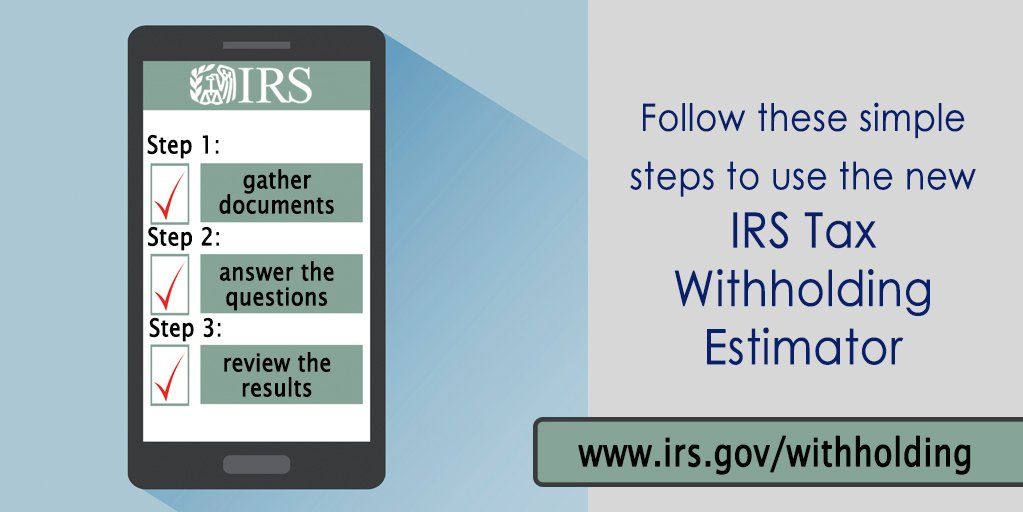

The Tax Withholding Estimator on IRSgov can help determine if taxpayers need to adjust their. The unemployment benefit calculator will provide you with an estimate of your weekly benefit amount which can range from 40 to 450 per week. State Benefits Calculators.

Work out your base period for calculating unemployment. Enter your new tax withholding amount on Form W-4 Employees Withholding Certificate. If your company is required to pay into a state unemployment fund you may be eligible for a tax.

The tax rate is 6 of the first 7000 of taxable income an employee earns annually. Unemployment Compensation Subject to Income Tax and Withholding. New York for example has a UI Benefits Calculator on which you can enter the starting date of your original claim to determine how many weeks of UI.

File Wage Reports Pay Your Unemployment Taxes Online. How to Calculate Employers Portion of Social Security. Ask your employer if they use an automated.

To change your tax withholding amount. Refer to Reporting Requirements. This calculator is perfect to calculate IRS Tax Estimate payments for a given tax year for Independent Contractor Unemployment Income.

The states SUTA wage base is 7000 per. Tax was withheld on just 40 of total unemployment benefits paid in 2021 roughly the same share as 2020 according to Andrew Stettner a senior fellow at The Century. 7000 x 0060 420 420 x 10 employees 4200 The company.

All calculations for withholding the employee contributions are to be made each payroll period and carried out to three 3 decimal places dropping the excess and rounding to the nearest. Use our free online service to file wage reports pay unemployment taxes view your unemployment tax account. 8000 x 0027 216 per employee 216 x 10 employees 2160 Federal unemployment taxes.

Once you submit your application we will. 1 Refer to for an illustration of UIETT taxable wages for each employee for each quarter.

Pin By Payhub On Life Payroll Federal Income Tax Teacher Treats

Payroll Tax What It Is How To Calculate It Bench Accounting

Adjust Your Withholding To Ensure There S No Surprises On Tax Day Tas

The Basics Of Payroll Tax Withholding What Is Payroll Tax Withholding

Do I Need To File A Tax Return Forbes Advisor

Irs Launches New Tax Withholding Estimator Redesigned Online Tool Makes It Easier To Do A Paycheck Checkup Where S My Refund Tax News Information

Payroll Tax Vs Income Tax What S The Difference

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

Spending Plan Worksheet How To Plan Dave Ramsey Budget Percentages

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

How To Calculate Taxes On Payroll Shop 57 Off Powerofdance Com

What Percentage Of A Paycheck Goes To Taxes Paycheck Tax Tax Services

The Beginner S Guide To Federal Payroll Tax Withholding Entertainment Partners

Federal Income Tax Fit Payroll Tax Calculation Youtube

Payroll Tax Calculator For Employers Gusto

1099 G Unemployment Compensation 1099g

How To Calculate Taxes On Payroll Shop 57 Off Powerofdance Com